Have you ever wondered why rich people are always ranked by net worth, and us mere mortals talk in terms of income? Me too, and not too long ago my net worth was in the red. With a few simple steps you can transform your financial status quickly.

“It’s not how much money you make, but how much you keep..” – Robert Kiyosaki

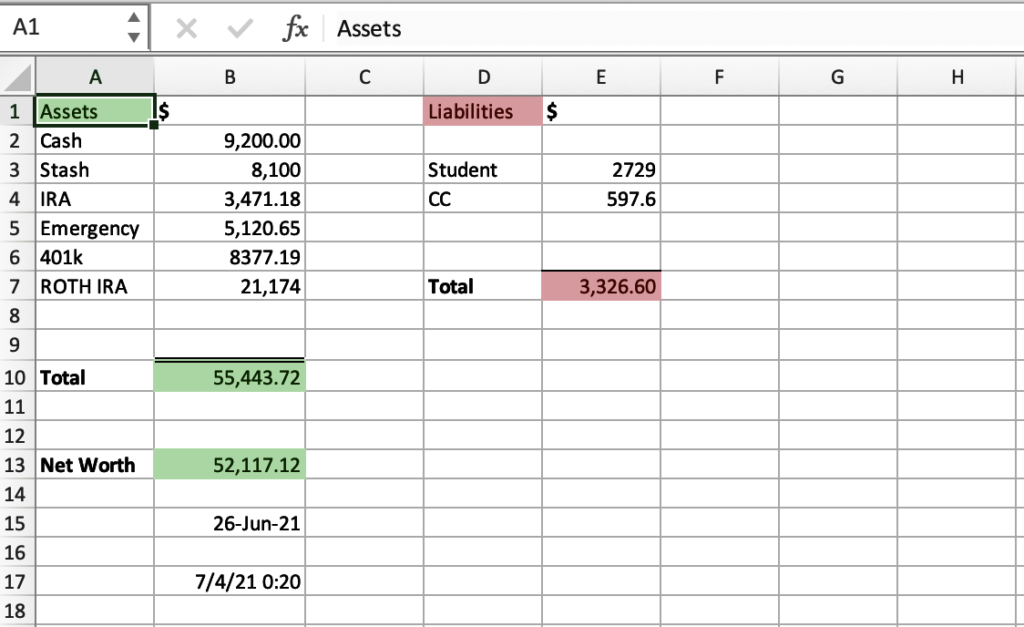

Net worth is calculated by adding up all of your assets a.k.a. any thing you own (houses, cars, stocks, bonds, gold, bitcoin, etc.) and subtracting your liabilities or debts (credit card debt, student loans, mortgages, auto loans, etc.). The amount you are left with is your net worth. Billionaires like Jeff Bezos own a lot of shares in the companies they built, that stock rose to high amounts and it reflects in their astronomical net worth. To begin, start an amazing company and take it public or if you’re just wanting to improve your situation here are the initial five steps.

Where do you stand?

“…to find where you are going, you must know where you are.” – John Steinbeck

The first step is to know exactly where all of your money and valuables are. These need to be accounted for and added up. That money you have stashed under the mattress, on layaway that started 10 months ago for something you don’t really need, or in multiple different investment accounts all need to be summoned. Surprisingly, this took a little bit of digging and thinking to find everything and add it up, it can be disorganized! Once, you have all of your assets and valuables in a pile, it’s time to look at those wretched liabilities. Yup, who and what do you owe?

Same idea here, only this time we’re adding up the debt. Exactly what debts are against you and how much? Creditors like the bank that loaned you money for a car, mortgage, student loans and those sneaky credit cards that some how always have a balance need to be rounded up and totaled. This can be tricky as well, and sites like Credit Karma are great at pulling it all together for us. I use these reports regularly and it has made this part much easier.

Adding up all of your assets and liabilities can be quick, so be as thorough and conservative in estimating values as you can. Personally, I leave my home and car value out as well as my mortgage debt which I will explain later. Unfortunately, the car loan isn’t the best debt and must stay on your list of liabilities.

After, take the amount you calculated from all of your assets (valuable stuff) and subtract the total liabilities (debts) found. The number you are left over with is your net worth. If you sold all of your stuff today, took the cash and paid off all of your debt, how much are you left over with?

Stay organized with tracking!

“Everybody wants millions.. If you can’t even keep track of a few pennies, how are you about to keep track of millions?” – Eric Thomas

This step is essential and often overlooked. It’s easy to struggle with so there’s a few things we can do to make it 100% accurate and up to date. Many great leaders have suggested that the habits we establish when the amounts are small will definitely translate when we become rich. We have to keep an updated organized “tracker” of our net worth and change it regularly. This keeps it fun and motivating to see our assets grow and our debts shrink. It’s best to update it every time you get paid to hold yourself accountable and watch your progress, especially in the beginning.

Above, is a simple net worth tracker that I made in excel. This took all of 5 minutes to create and does the math for me. I check the accounts that were neatly organized in step 1 and 2, then update the numbers in the tracker and see my results. Simple and effective! Make yours now either in excel, on a sheet of paper or anywhere you will see it regularly. The goal is to watch your net worth jump day by day week by week.

Mindset Matters

“Business opportunities are like buses, there’s always another one coming” – Richard Branson

If you want to build wealth and get out of your current financial level we have to think about money in a way that attracts it. Money is abundant on earth, c’mon people can spend $50,000 on purses and watches to show off. The idea that if your neighbor gets rich, there is less for you and I is complete nonsense. Your neighbor just made it way easier for your to get rich. They have shown it can be done and have brought riches right to your street! It’s easy to get caught up in a scarcity mindset and hold on to our money tightly in a savings account. Unfortunately, this is suffocating your net worth..

Currency is like water and it must flow or risk becoming stagnant. Its very name means current! When I first started out, I built up my savings account and was afraid to invest, buy valuable assets or pay of stubborn high interest debt. This was purely out of the fear that the number in my account was going to drop. The opposite is true! I bought a new roof and within a few months I had already earned the money back and now the value of my home greatly increased.* Get in the habit of moving big amounts around, which in my case $1,000 – $3,000 was a big deal. If you are to afraid to invest 10 dollars there’s no way you’ll invest $10,000 and definitely not 10 million! Move money into your investment accounts, put a downpayment on a piece of real estate and pay down that debt.

Pro tip: capital improvements like a new roof can be a tax write off. Consult with a tax professional even when you don’t have much and build a relationship! When you’re rich they are the real MVP.

Another stumbling block for most people is the way we think about debt. When we pay down debt our net worth increases in the exact same proportion as if we saved that money. We become emotionally attached to seeing the number in our savings account rise and end up protecting it at all costs. At one point, I had $10,000 saved and a car loan in my name for $4,500 at 4.1% interest. This four thousand dollar loan was working against me. The money in my savings account is earning .001%. Take the money and pay off the car, its an automatic 4% return and your net worth has stayed the same. Plus, money each month is freed up. Additional cash flow from the eliminated car payment makes it easier to load the saving-to-invest account back up. Realize, it is an emotional attachment to seeing that big amount in your savings. We need to appease both our emotional side and mathematical side for this to work and attaching positive emotion to eliminated debt.

Investments Come in All Shapes and Sizes

Does the word investing scare you? The fastest way to build net worth is earning high returns on your money. The accounts that will help us if you are just starting out are going to be ROTH IRA’s, Traditional IRA’s, 401ks, self directed brokerage accounts, owner occupied and rental real estate and buying equity in businesses. The methods used to get there very, however, one agreed upon tactic is automation. You have to automate your investments by scheduling the online brokerage to take money from your account at a set time each week and month. I set my Vanguard Roth IRA to deduct 100 dollars weekly and invest it into their S&P 500 Index Fund (VFIAX). Another great online brokerage is Stash. They help you understand different terms used in the financial game, automate your investments and invest in various stocks, bonds, reits, and ETFs. This is where my journey began, saving 10 bucks a week and increasing contributions as my income rose. This account now is worth $10,000 after a few short years. I highly recommend Stash to anybody looking for a great way to start investing today! Use the link Stash to get a free 20 dollars of stock when you join.

Good deals are in the market every single day, wether its underpriced Apple stock or your neighbor is trying to get rid of a motorcycle quick, deals are out there. To this day, Ive made solid returns on buying nice watches, used motorcycles and penny stocks. These have increased my net worth and made me resourceful. If there’s an area you are competent in like high end purses or cool classic cars, these are ways to invest money and make large returns outside the traditional assets like stocks, bonds and real estate. Although, those types of investments are fun and exciting the back bone of my net worth is in the stock market. Safely secured in tax safe accounts like the Roth IRA and Traditional IRA.

Remember, the key here is to have fun with it. After all, we are doing this to experience a better life. We all want more love, friendships, travel, happiness, generosity, and cool things money will help make that easier. This is a journey and there will be ups and downs. Once I owed a decent amount of SNAP stock at 6 dollars and sold when it doubled. At the time of writing this it is now worth $68. At the time I sold, I was the smartest man alive, now it’s a learning lesson that is paying dividends. Keep at it and if you feel lost or want one-on-one coaching to get started quicker I’m here to help, contact me.

Pick a strategy and stick to it

“Someone’s sitting in the shade today because someone planted a tree a long time ago.” – Warren Buffet

Have you been enticed be fad investments, get rich quick schemes and fallen into the trap of investing in something that’s all the hype? We’ve all been tempted and its what gives investing its risky reputation. Personally, I’ve seen coworkers lose 85% of their investments jumping into an over hyped penny stock at the exact time everyone was about to sell. This can happen to the best of us so we need to pick a strategy and stick to it!

My strategy goes like this: save 30% of my income. A portion of that is taking advantage of my employers 401k up to and only in the amount they will match. That happens to be 4%. Next, maxing out my Roth IRA with automatic contributions weekly through Vanguard. Fifty dollars a week automatically goes into a self directed brokerage account through Stash, where I mimic Warren Buffets strategy. You can learn more by searching value investing, Warren Buffet stock picks or check back here for a break down of this strategy coming soon. Finally, the rest goes straight into my saving-to-invest account. By building this account up I am locked and loaded to jump on any real estate, market downturn, and opportunities that may come my way. The market is highly priced now and having a stock pile of cash could make for some great buys down the road. You need to pick a strategy that’s suited for you, with the amount of risk you are willing to take, and providing enough excitement to keep you interested.

The strategy of the rich is to own real estate, businesses and stocks. This has been making and maintaining riches for centuries. Build your foundation with a combination of these three and stick to building each up. I have a vending machine business that funds the repairs for my rental property. One asset is building the next asset, which in turn frees up money to invest more in my accounts. Each and everyday the accounts are increasing because of consistent reliable investments.

You need pick a strategy and stick to it, consistency is key. Do not get caught up in investing in Doge coin, BTC or a penny stock because everyone is doing it. If you don’t understand what it is you’re investing in, generally it’s going to be a bad investment for you. This is not to say these aren’t good places to put your money. Personally, I don’t understand them enough to feel confident putting my money in crypto so I avoid the hype. This allows more time to research companies I feel good about and have a solid track record like Tempur-Sealy.

Key Take-Aways

- Figure out where all of your money is and what debts are against you.

- Make a list, organizing these assets and liabilities so you can track your progress.

- Continually seek out more knowledge and train your mindset to attract money, think about it emotionally and mathematically and make better decisions.

- Seek out investment opportunities that are exciting, reliable and tailored to you. Don’t hesitate and jump in! This is the way to increase net worth exponentially.

- Keep it together, stay consistent with automated investments and do not deviate from a chosen strategy. This will straight line you to wealth and a high net worth.