Should I buy Tesla or apple stock? Will bitcoin or doge coin be the best cryptocurrency? Forget all that, ignore the hype because those are failing tactics for most. We’re going to go straight to the point combining two amazing strategies from the legends Ray Dalio and Jack Bogel. Use this strategy listed below for great place to put your money today.

The two strategies are The All Weather Fund by Ray Dalio along with Jack Bogel’s concept of reducing fees and commissions through indexing to create high returns, ultra-low risk and next to no fees eating away at returns. Here it is:

All Weather Fund with percentages:

- 30% – Stocks

- 40% – Bonds

- 15% – Intermediate Bonds

- 7.5% – Commodities

- 7.5% – Precious Metals

This investment mix has a proven track record of capturing gains when the market is bullish and preventing huge drops when the market takes a turn for the worst. Consider it for a lifetime strategy or when nearing the retirement age because..

Since 1984 hypothetically

This allocation has 9.7% returns / Make money 86% of the years / biggest loss is -3.9% / low volatility

According to the book Money Master the Game by Tony Robbins, he interviewed Bridgewater Associates founder Ray Dalio to give us this easy to copy asset allocation. It’s a big deal because being the exact same formula the largest hedge fund in the world uses not many people have been exposed to it. This is one of the best secrets disclosed from reading the entire book.

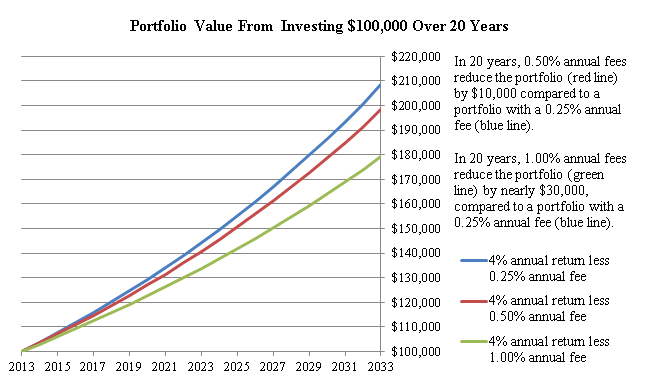

In the book, Tony also interviews the great Jack Bogel founder of Vanguard. The leader in low cost investing, and the inventor of Index Funds. The biggest take away..

“Fees and commissions charged by funds and financial advisors are a leak in your financial nest egg. Over the course of a lifetime, this cost the average investor thousands of dollars and loads of missed opportunity. Eliminate fees and keep your money working for you.“

What fees are you being charged right now?

Chances are if your money is in a 401k or mutual funds with a financial advisor the fees are too high. This is a leak in your portfolio and the value the fund manager provides doesn’t make up for it. We get the best advice from the pioneer in low cost investing, John C. Bogel.

“Don’t look for the needle in the hay stack, just buy the hay stack!” – John C Bogel

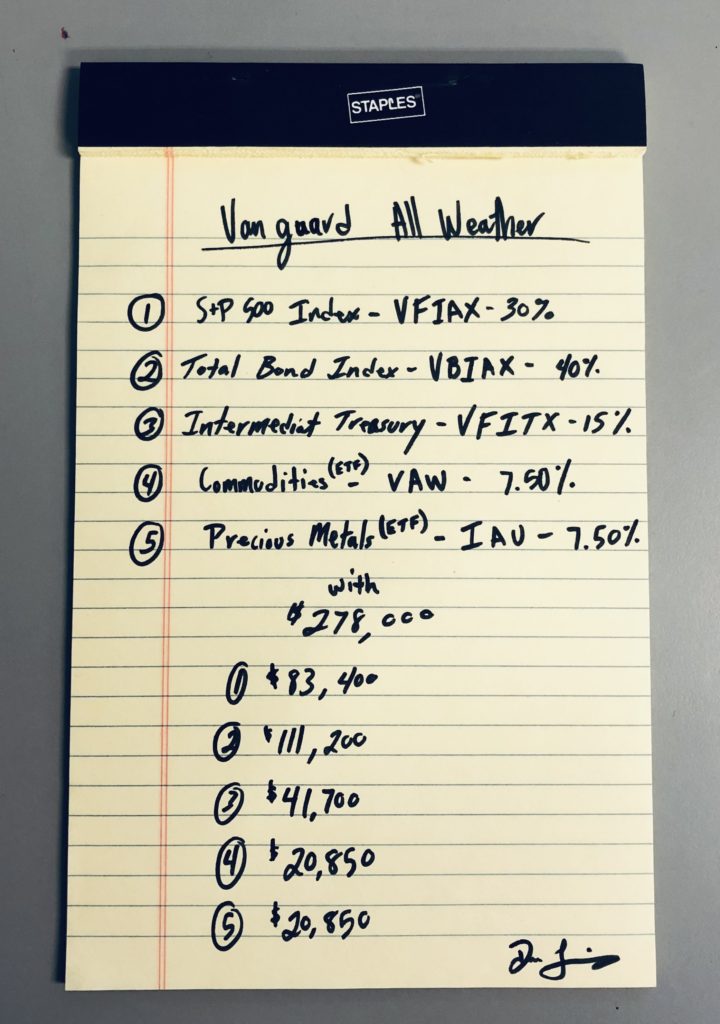

We’re going to use Bogel’s advice and combine it with Ray’s to create an ultra low cost all weather fund that anyone can mimic with complete ease. I wrote this down on a legal pad for a client after listening to Money: Master the Game by Tony Robbins and then reading Common Sense Investing: The little red book on investing. By John C. Bogel. This is what we did for her..

Here’s an example of my client Nancy’s situation:

She has a retirement account with most of her money, is in her mid 50s and is planning on retiring in 7 years. Hopefully, she can pass some money on to her two daughters. She needs to take advantage of the growing economy and stay safe enough to not lose her shirt in a market downturn. Here’s what we did and in what amount..

We are working with $278,000 in her retirement account and want to reduce costs with Index funds

- $278,000 x 30% = $83,400 needed to be invested in stocks.

- We are using the ticker symbol VFIAX – Vanguard 500 Index

- It has a $3,000 minimum and a lowest in class .04% expense ratio

- It Is also available in ETF form for lower net worth individuals.

- 7.84% returns since inception 11/13/2000

- $278,000 x 40% = $111,200 invested in Bonds

- We are using VBIAX – Vanguard Balanced Index

- It has a $3,000 minimum consist with most vanguard funds

- The expense ratio also very low at .07%

- 7.25% returns since inception 11/13/2000

- $278,000 x 15% = $41,700 invested in Intermediate Treasury Bonds

- We are using VFITX – Vanguard Intermediate-Term Treasury Fund

- Also has a $3,000 minimum and an expense ratio of .2%

- 5.47% returns since inception 10/28/1991

- $278,000 x 7.5% = $20,850 invested in Commodities

- We are using a Vanguard Materials ETF – VAW

- Boasts a massive 52% return YTD (currently mid 2021)

- Potential to continue to be bullish as material prices are staying high and demand is there

- 9.81% since inception 01/26/2004

- .1% Expense ratio

- $278,000 x 7.5% = $20,850 invested in Precious Metals

- We are using iShares Gold Trust – IUA

- 499.71 Tonnes of Gold in Trust

- 8.69% since inception

- .25% expense ratio

- Vanguard doesn’t have a precious metals index or ETF, this is the next best option.

There is a real life example of this Ultra Low Cost All weather fund in action! This may be one of the best investment allocations currently for any investor and certainly a life long strategy. If you want help setting up your portfolio, nest egg or just have some questions comment below or send me an email for a One-on-One Coaching session!

One-On-One Coaching

Pingback: 5 of the Best Finance and Investing books Ever Written. *Warning: they will change the way you think about money.* – Foundation Investing